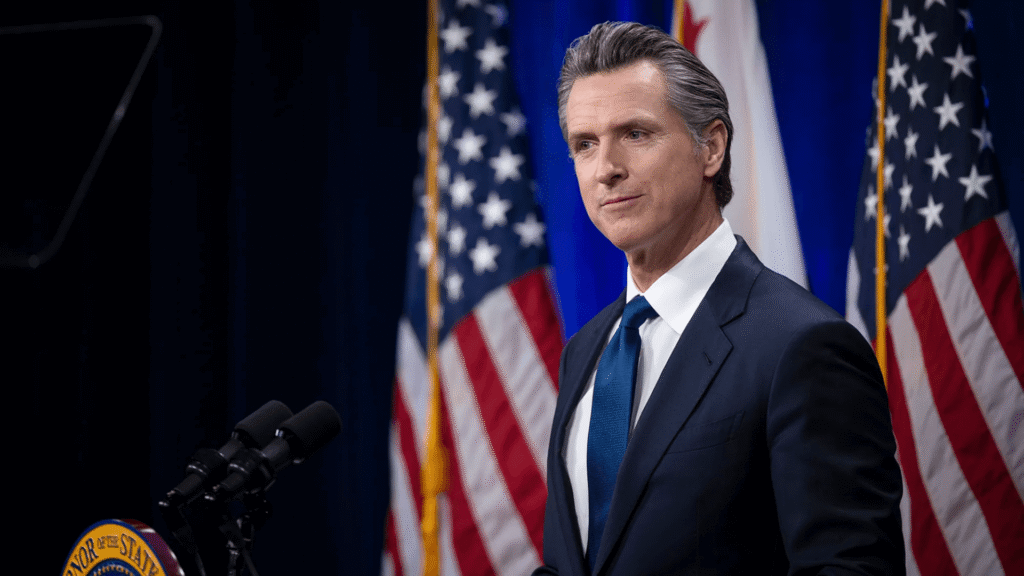

Governor Gavin Newsom’s recent executive order on insurance stability is making headlines across California. Designed to tackle the state’s growing insurance challenges, this order aims to ensure that both residents and businesses have access to reliable, affordable insurance coverage.

In simple terms, the Governor Newsom insurance order sets a new direction for how California’s insurance system works—focusing on fairness, transparency, and long-term sustainability. With natural disasters such as wildfires and floods becoming more common, insurance companies have been pulling out of the market or raising rates dramatically. The executive order is meant to restore balance by encouraging insurers to stay in California while protecting consumers from unreasonable costs.

Why California Needed An Insurance Reform Update

Over the last few years, California has faced what many experts call an “insurance availability crisis.” Major insurers stopped writing new homeowners and commercial policies in high-risk areas, leaving thousands of families and small businesses struggling to find coverage.

For example, after the 2020 wildfires, some Northern California communities saw insurance premiums rise by over 30%, while others were dropped altogether. Small business owners—especially in rural or fire-prone regions—often had to rely on the FAIR Plan, the state’s last-resort fire insurance program.

Governor Newsom’s insurance reform update seeks to stabilize this market by ensuring that companies who benefit from doing business in California also take on their fair share of risk.

A “Whole-Of-Government” Approach To Insurance Stability

One of the most important features of the Governor Newsom insurance order is its “whole-of-government” strategy. This means the state is bringing together multiple agencies—like the California Department of Insurance (CDI), CAL FIRE, and CalOES (the Office of Emergency Services)—to work collaboratively rather than independently.

According to Insurance Commissioner Ricardo Lara, this united effort allows California to anticipate risk instead of just reacting to disasters. For instance, if CAL FIRE identifies areas with increased wildfire danger, the CDI can use that data to create incentives for insurers who offer coverage in those regions.

This approach helps ensure that Californians in every ZIP code—urban or rural—have a fair chance at affordable coverage.

How This Order Impacts Consumers And Homeowners

If you’re a homeowner, this executive order could have a direct impact on your insurance premiums and coverage options. The order supports a Sustainable Insurance Strategy, which has already encouraged five major insurance companies—including three of California’s largest homeowners carriers—to stay and expand their presence in the state.

This means:

- More insurance options for homeowners.

- Reduced dependency on the state FAIR Plan.

- Better stability in pricing over time.

For example, a homeowner in Sonoma County who previously had only one available insurer might soon see three or four competitive offers. That competition could help reduce rates or at least slow down increases.

The order also ensures that the Department of Insurance reviews rate filings carefully to make sure consumers don’t pay more than necessary.

What Small Businesses Need To Know

Small businesses and startups are among those most affected by insurance costs—especially in industries like retail, construction, hospitality, and agriculture. When premiums spike or policies are canceled, operations can grind to a halt.

Under this new California insurance update, the goal is to make sure that small business owners can maintain consistent coverage without facing sudden nonrenewals. For example:

- Restaurants and shops near wildfire zones will have clearer risk maps and access to state-supported insurance options.

- Construction firms and contractors may benefit from expanded liability coverage options as more insurers reenter the market.

- Agricultural businesses could see better crop and property protection, especially in drought-prone or fire-risk regions.

The long-term result? A more predictable business environment where entrepreneurs can focus on growth instead of worrying about losing their coverage.

Key Laws And Regulations That Matter

This executive order builds on several California laws already in place to protect consumers and stabilize the insurance industry:

- Proposition 103 – This voter-approved law requires the Insurance Commissioner to approve rate changes before they take effect, preventing unjustified premium hikes.

- SB 254 – Signed recently, this bill calls for a comprehensive statewide insurance preparedness report, which will identify gaps in disaster readiness and improve coordination between state agencies.

- The Sustainable Insurance Strategy (SIS) – Commissioner Lara’s initiative that focuses on creating data-driven incentives for insurers to stay active in California’s high-risk zones.

Together, these efforts support the broader vision behind the Governor Newsom insurance order—a safer, more resilient California where insurance remains accessible for all.

Practical Tips For Californians

Here’s what residents and business owners can do right now to prepare for the changes:

- Review Your Policy Annually: Make sure your coverage reflects current property values and risks.

- Ask About Discounts: Many insurers offer lower premiums for homes with fire-resistant roofs, defensible space, or upgraded sprinkler systems.

- Explore Multiple Quotes: As more insurers reenter the market, compare options through a licensed broker or the Department of Insurance’s online tools.

- Stay Informed: Follow California insurance updates from official state websites to understand how future reforms may impact your area.

Looking Ahead: A Path Toward Stability

While challenges remain, the Governor Newsom insurance order represents a significant step toward restoring confidence in California’s insurance market. By combining leadership, data, and accountability, the state is creating conditions where insurers can thrive and consumers can feel protected.

This initiative isn’t just about lowering rates—it’s about building a system that can withstand the realities of climate change, support small businesses, and ensure every Californian has access to the protection they deserve.

With the Governor’s leadership and public cooperation, California is setting a national example in how to balance insurance reform, consumer protection, and economic resilience—one policy at a time.