California is a huge and diverse state—spanning tech hubs, farmland, forests, and coastlines. That variety means its economy brings big opportunities …and big risks. For businesses in “high‑risk” industries, one serious misstep could mean massive financial hits. That’s why high risk business insurance is not just useful—it’s essential.

Below, we’ll explore the top 10 high‑risk industries in California, why they matter, and how insurance helps—backed by law, real data, and practical tips.

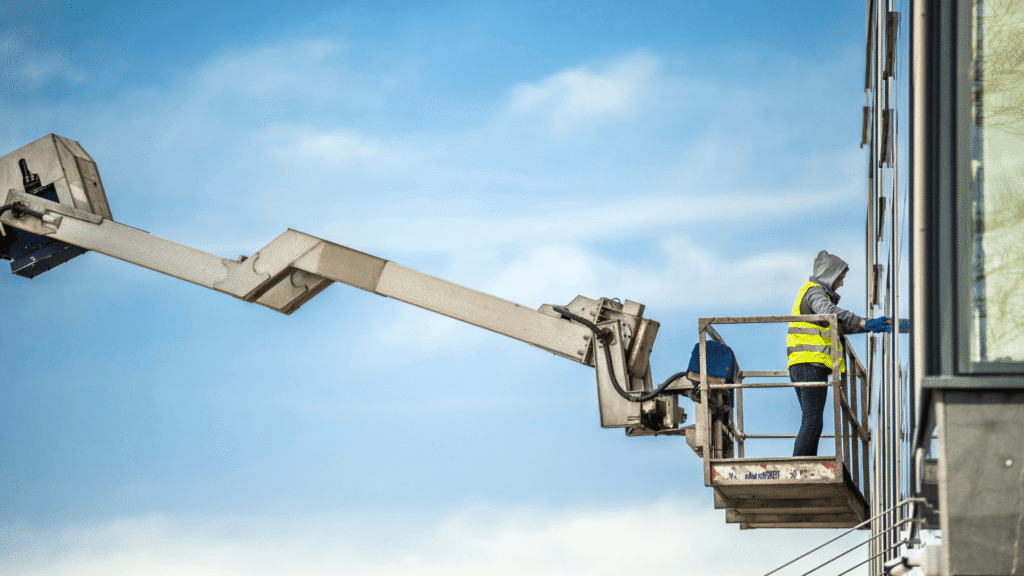

1. Construction & Contracting

Why it’s high‑risk: Falls, machinery, falling objects – construction leads the state’s job‑site injuries, especially among Hispanic workers, who are 41% more likely to die on site.

Insurance needs:

- Workers’ compensation (mandatory under CA Labor Code §3700)

- Builder’s Risk Insurance covers buildings under construction

- General Liability protects against claims like property damage or third‑party injury.

Practical tip: Use strong safety programs. Insurers offer lower rates for certified training and compliant practices.

2. Agriculture & Farming

Why it’s high‑risk: Machinery, animal handling, pesticide exposure, and extreme heat—climate change is causing $100 billion in annual agricultural losses across the US . CA alone grows ~$43 billion in crops.

Insurance needs:

- Workers’ compensation (with high‑heat illness coverage).

- Crop insurance against drought, fire, and pest damage.

- Liability insurance for pesticide drift or accidents.

Example: Central Valley farms face wildfire smoke and extreme heat—parametric insurance pays out once heat crosses a predetermined threshold

3. Oil, Gas & Mining

Why it’s high‑risk: Heavy machinery, underground hazards, and environmental liability.

Insurance needs:

- Workers’ compensation (mandatory).

- Environmental liability for spills.

- Excess Liability/Umbrella for large claims.

Example: Coastal oil platforms must also manage earthquake riders and offshore drilling risks.

4. Forestry, Logging & Tree‑Trimming

Why it’s high‑risk: Chainsaws, falling limbs, rough terrain—fatal injury rates are very high.

Insurance needs:

- Workers’ compensation (required).

- Commercial auto for equipment transport.

- Liability insurance for property damage.

5. Healthcare & Medical Services

Why it’s high‑risk: Needle sticks, patient lifting injuries, disease exposure—and California’s regulation is tough.

Insurance needs:

- Workers’ compensation (covering injuries and infections).

- Professional liability for malpractice.

- General liability for slip-and-fall or patient interactions.

6. Utilities & Energy

Why it’s high‑risk: Equipment, electrical hazards, and major climate-related wildfire exposure.

Insurance needs:

- Workers’ compensation.

- Asset/property for equipment damage.

- Liability insurance for fire-spread damage.

Case study: PG&E and other utilities hold deep liability for wildfires—the 2018 Camp Fire led PG&E into bankruptcy and over $12 billion in insured losses.

7. Transportation & Trucking

Why it’s high‑risk: Road accidents are the top cause of work-related deaths.

Insurance needs:

- Workers’ compensation.

- Commercial auto (required in CA).

- Cargo insurance for goods.

- Liability for injuries or damage.

8. Manufacturing & Industrial

Why it’s high‑risk: Heavy machinery accidents, chemical exposure, and repetitive strain.

Insurance needs:

- Workers’ compensation (with high classification codes).

- Product liability.

- Pollution liability if chemicals are used.

Tip: A strong safety record can lower premiums by improving your Experience Modification Rate (EMR)

9. Security Services & Private Investigation

Why it’s high‑risk: Guard work may involve threats, gun exposure, or physical altercations.

Insurance needs:

- Workers’ compensation.

- Professional liability for misconduct.

- General liability for client or public claims.

10. Hospitality & Food Production

Why it’s high‑risk: Kitchen burns, slips, and foodborne illness exposures are common.

Insurance needs:

- Workers’ compensation.

- General liability.

- Product liability for food contamination.

Why This Matters for Californians

- Strict legal rules: California mandates workers’ comp for any employer with at least one employee.

- Climate-driven risk: Insurance is becoming scarcer for wildfire-vulnerable businesses. The FAIR Plan has expanded dramatically—covering 20% of high-risk zip codes.

- Economic footprint: These industries employ millions and contribute critical revenue—from tourism to technology.

Without insurance, an accident or natural disaster could shutter even a once-thriving California business or ruin a local family.

How Insurance Works for High‑Risk Industries

1. Workers’ Compensation (WC)

- Required under CA Labor Code § 3700 for all employers with employees

- Covers medical costs and lost wages for work injuries.

- Costs vary by classification code, safety record, and EMR .

2. Property & Builder’s Risk

- Provides coverage during construction or renovation phases.

- Must include endorsements for CA-specific threats, like earthquakes or wildfires.

3. Liability & Umbrella

- Protects from third‑party claims.

- Umbrella policies cover beyond what standard liability covers—crucial in high-stakes industries.

4. Specialty Policies

- Includes environmental or pollution liability.

- Parametric insurance pays out based on objective metrics like temperature or wildfire index.

Tips for Business Owners

- Talk to a specialist broker—they know high-risk business insurance options.

- Invest in safety—better training and certification lower rates by improving your EMR .

- Track claims history—promptly report everything to avoid gaps or increased premiums.

- Stay legally compliant—don’t skip mandatory coverage like WC, builder’s risk, or auto insurance.

- Explore new risk tools—parametric and catastrophe-linked coverage can be cost-effective under new regulations.

Data Snapshot: CA Insurance Trends

| Metric | 2023/2024 |

| CA FAIR Plan’s exposure | $529 billion (↑15% since Sept 2024) |

| Premium rise | House insurance up 43% from Jan 2018 to Dec 2023 |

| WORST wildfire | Camp Fire→ $12.5 billion insured losses, $16 billion total |

| Worker safety | 80% of CA businesses are experience‑rated for WC |

Final Thoughts

California is a land of opportunity—and natural beauty. But it also brings complex risks: from falling objects and farm machinery to wildfires and heat waves. For high-risk industry businesses, strong insurance isn’t just smart—it’s required.

With the right mix—workers’ comp, property risks, liability, and newer parametric tools—you protect your team, your customers, and your business future.

Take action today: review your risks, invest in safety, and speak to an experienced broker. Because in California’s dynamic landscape, insurance isn’t an expense — it’s your future’s foundation.